Understanding school taxes can feel like navigating a maze. For many homeowners, these taxes are a significant part of their annual expenses. But how do you compute school taxes? It’s not as daunting as it seems. By breaking down the process step by step, you’ll find that calculating your school taxes is manageable and straightforward.

In this blog post, we’ll explore what school taxes are, why they matter, and the factors that influence their rates. Whether you’re looking to budget better or simply curious about where your money goes, we’ve got you covered. Let’s dive in!

What are School Taxes?

School taxes are a specific type of property tax collected to fund public education. These funds support local schools, covering everything from teacher salaries and classroom supplies to building maintenance and extracurricular activities.

In most areas, school taxes are assessed based on the value of real estate owned by residents. The more valuable your property, the higher your potential tax bill could be.

These taxes play a vital role in ensuring that children receive quality education in well-equipped environments. They help maintain facilities, provide necessary resources, and improve educational programs within the community.

School taxes directly impact not only students but also local neighborhoods by contributing to overall community development and growth. Understanding this financial obligation helps homeowners appreciate where their contributions go.

Why are School Taxes Important?

School taxes play a vital role in funding education. They provide the necessary resources for schools to operate effectively, hire qualified teachers, and maintain facilities.

These funds support various programs that enrich student experiences. Extracurricular activities, sports teams, and advanced placement courses often rely on this financial backing.

Moreover, school taxes help ensure that all students have access to quality education regardless of their background or location. This investment in education fosters community development and can lead to long-term benefits for society as a whole.

When communities prioritize school funding through taxes, they are essentially investing in the future workforce. A well-educated population drives economic growth and innovation.

In essence, school taxes create opportunities for learning and personal growth while also contributing to overall societal progress. The impact of these funds extends far beyond classroom walls into broader community welfare.

Factors that Affect School Tax Rates

School tax rates aren’t set in stone; various factors come into play. One primary influence is the local property values. As home prices rise, so do assessments, which can lead to higher tax rates.

Enrollment numbers also play a crucial role. A growing student population often requires additional funding for resources and staff, driving up school taxes to meet these needs.

Another factor is state funding policies. States may provide less support during budget cuts, shifting more financial responsibility onto local taxpayers.

Local economic conditions cannot be overlooked either. In areas facing economic challenges, there might be an increased reliance on property taxes as other revenue sources dwindle.

Community priorities impact school budgets significantly. Voter-approved measures for new facilities or programs can directly affect how much residents pay in school taxes each year.

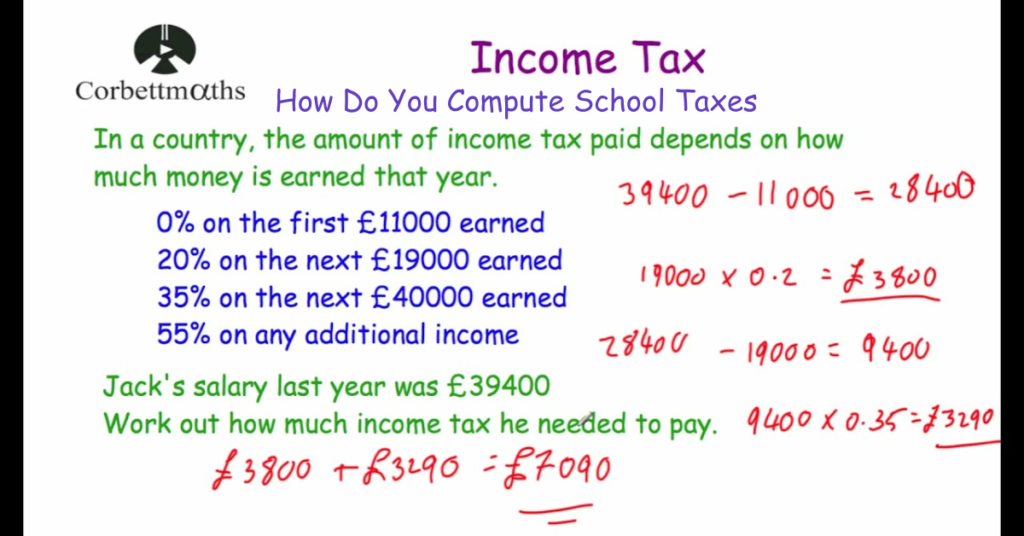

How to Compute School Taxes:

To compute school taxes, start by determining the assessments and millage rates. Assessments reflect the value of your property as determined by local tax authorities. Millage rates are set percentages that dictate how much you owe per $1,000 of assessed value.

Next, calculate the assessed value of your property. This is usually a percentage of its market value, depending on local regulations.

After establishing these figures, multiply the assessed value by the millage rate to get your base tax amount. For instance, if your property’s assessed value is $200,000 and the millage rate is 20 mills (or 0.020), then you would owe $4,000 in school taxes.

Don’t forget to factor in any special assessments or exemptions applicable to you; these can significantly impact your final tax bill and may provide some relief from high costs.

A. Determine the Assessments and Millage Rates

To compute school taxes, start by determining the assessments and millage rates. Assessments represent the value placed on property by local authorities for tax purposes. This value is often derived from market conditions and can vary significantly based on location.

Millage rates are expressed in mills, where one mill equals $1 of tax per $1,000 of assessed property value. These rates are set annually by school boards or local governments to fund educational programs and services.

The key here is understanding that both assessments and millage rates fluctuate over time. They depend on various factors such as state legislation, community needs, and budget requirements. Keeping track of these changes ensures you have an accurate picture when calculating your school taxes. Always consult official sources or a tax professional for the latest figures specific to your area to avoid any surprises come tax season.

B. Calculate the Assessed Value

Calculating the assessed value is a crucial step in determining your school taxes. This figure represents the portion of your property’s market value that local tax authorities will use for taxation.

Each area has its own assessment ratio, typically established by the local government. This ratio helps to ensure fairness and consistency across various properties within a jurisdiction.

To find your assessed value, multiply your property’s fair market value by this assessment ratio. For example, if your home is worth $300,000 and the assessment ratio is 80%, the assessed value would be $240,000.

Keep in mind that different types of properties may have varying ratios. Always check with local officials to understand how these figures apply specifically to you. Understanding this number can greatly influence how much you’ll pay in school taxes each year.

C. Multiply the Assessed Value by the Millage Rate

Once you have the assessed value of your property, the next step is to multiply it by the millage rate. This process helps determine how much you will owe in school taxes.

The millage rate represents the amount per $1,000 of assessed value. It’s typically expressed as a decimal or percentage. For example, if your local millage rate is 0.05 (or 5%), this means you’ll pay $50 for every $1,000 in assessed value.

To perform this multiplication accurately, ensure that both values are correctly calculated first. A small error can lead to significant differences in your tax bill.

So if your home has an assessed value of $200,000 and the millage rate is 0.05, simply multiply:

$200 x 0.05 = $10,000

This total indicates how much you’ll contribute towards funding local schools through taxes each year.

D. Adding Special Assessments or Exemptions

When calculating school taxes, it’s crucial to consider any special assessments or exemptions that may apply to your property. Special assessments are additional charges imposed for specific local projects, like road improvements or new schools. These can significantly impact your total tax bill.

On the other hand, exemptions can reduce your taxable value. Many areas offer exemptions for seniors, veterans, or low-income households. Each exemption has its criteria and application process.

To benefit from these adjustments, you must stay informed about what is available in your area. Check with local tax authorities regarding deadlines and required documentation.

Taking advantage of available exemptions and considering special assessments will help ensure an accurate computation of your final school tax amount.

Tips for Reducing Your School Tax Bill

To reduce your school tax bill, start by reviewing your property assessment. Ensure that the value assigned to your home reflects its actual market value. If you find discrepancies, consider appealing the assessment.

Look for exemptions or credits available in your district. Many areas offer benefits for seniors, veterans, or those with disabilities. Research what applies to you and submit the required paperwork promptly.

Another effective method is to get involved in local governance. Attend school board meetings and stay informed about budget decisions that could impact taxes.

Maintain clear communication with local tax officials. They can provide guidance on any changes in regulations or new programs designed to help taxpayers save money.

Conclusion

Understanding how do you compute school taxes can feel overwhelming, but it doesn’t have to be. By breaking down the process into manageable steps, you can gain clarity on what affects your tax bill and how to calculate it accurately. Knowing the importance of these taxes helps highlight their role in funding essential educational services.

By considering various factors such as assessments, millage rates, and any special exemptions or assessments that may apply to you, you empower yourself with knowledge and control over your financial obligations. Plus, exploring tips for reducing your school tax bill could lead to further savings.

With this information at hand, you’ll be better equipped to navigate the complexities of school taxation. Whether you’re a new homeowner or simply looking for ways to understand your current situation more thoroughly, knowing how do you compute school taxes will serve you well in managing one aspect of your finances efficiently.

Get insights into the beautiful wedding of Paige Skinner and Jesse Fink in our exclusive article.